The insurance industry is in a continual state of flux, as regulations, risks, coverages, and rates all change over time. To navigate the ever-changing world of insurance, businesses (from the large carriers down to the small agencies) must be able to make informed, data-driven decisions.

In the current information landscape, merely having data available isn't sufficient. People are inundated (and sometimes overwhelmed) with information, and companies need to analyze that data in a meaningful way. Business intelligence software utilizes the power of big data to provide insurance companies additional insights into their data.

The Role of Business Intelligence for the Insurance Industry

Business intelligence supports all aspects of insurance data visualization, from profitability, operations, claims, marketing, and sales. A business intelligence platform works by analyzing vast amounts of data and then displaying it in a digestible manner. The software identifies the critical details and presents those details so that people who run and work for companies can easily understand their data—this includes both technical and non-technical end-users.

Insurance Dashboards and Reports BI Use Cases

- Claims analysis

- Call centers and claim data sheet dashboards

- Claimant correlation and fraud analysis

- Operational insurance reports

- Financial reports

- Executive overviews

- Claim-by-state reports

- Highest claim loss vs. premiums

- Agent performance reports

- Customer profiling

- And more

From C-level executive decisions to broker performance analysis, the data visualizations that business intelligence software provides help users improve performance at all levels.

BI is also helpful if you need to create a group presentation. With intuitive BI dashboarding and reporting software, users will spend less time creating slides or videos. Instead, end-users can quickly assemble interactive data visualizations for executive presentations.

In addition to providing analysis and data visualizations, insurance BI platforms also take care of back-end operations. They offer solutions for multi-channel data processing, data storage, data security, and other data-related challenges.

Let's take a deep dive into the benefits of BI for the insurance industry.

Provides Profitability Management - More Accurate Monetary Analyses

With a direct impact on profitability, business intelligence accurately analyzes multiple monetary factors.

Premium Analysis

An insurance company's primary source of revenue comes from premiums. Optimizing premiums is one of the best ways to improve top-line revenue without investing in new markets.

Business intelligence helps conduct in-depth premium analysis, tracking premiums' performance by individual product, product line, distribution channel, geographic region, or other factors. Such detailed analysis can focus on the highest-performing segments, optimize premiums across the board, or other revenue-increasing changes.

Product Profitability Analysis

Product profitability analysis investigates individual insurance products on a more detailed level, checking product performance and profit by distribution channel, geographic region, customer segment, and other factors.

When used for product profitability analysis, business intelligence software can check a product's premiums and its lapsations, claims, and other details.

Underwriting Loss Assessment

Should the premiums collected not cover the claims paid on an insurance product, an underwriting loss assessment is needed to recalibrate the policy. In this situation, business intelligence helps pinpoint the inaccuracies in the initial calculations and recalculate the premiums (or redesigning the product altogether) going forward. This is often the only way to make a product that sees overall losses profitable in the future.

While any insurance company might need to conduct an underwriting loss assessment, such a review has traditionally been incredibly beneficial to companies in medical insurance or similar industries. It's not too uncommon for claims to outpace premiums on health insurance policies.

As climates change and natural disasters increase in frequency, an increasing number of property and casualty insurers will also need to conduct these reviews.

Financial Analysis

A financial analysis that looks at conversion ratios, expenses ratios, and retention ratios is available for a broader overview than an in-depth analysis of a single product. Staying abreast of these ratios is essential to avoiding underwriting overruns and remaining profitable. Moreover, these ratios may be shown in a dashboard display since they're big-picture items and regularly needed.

Operational Management - Identifying Leakage, Retention, and Attrition Issues

Concerning an existing customer base, business intelligence helps identify where a company is losing policyholders.

New Business Leakage Analysis

New business leakages are a concern to businesses in any industry, but those in the insurance industry must pay special attention to new customers that are lost. With the prolonged timeframe and multi-step process necessary to onboard new policyholders, there are multiple points at which a policyholder might drop their new policy and not get coverage.

Business intelligence analyzes onboarding data to identify precisely when and why new customers drop their application or cancel their current policy. By reviewing items such as proposal withdrawals and bounced checks across distribution channels and geographic areas, insurers can identify steps to take that will better retain new customers.

Moreover, the benefit of this analysis goes beyond the financial costs of underwriting policies that aren't purchased and losing potential business.

When a new customer drops or withdraws their policy application, they might be dissatisfied with something in the process. This might lead to a lifelong lost customer or someone who complains about the company to others. Identifying and addressing whatever is causing the dissatisfaction will provide a benefit—far beyond just salvaging that customer's single policy.

Lapsation Analysis

Whether due to a customer changing insurers, lapses in insurance policies, deciding they no longer need coverage (or simply not paying a premium), represents a double-loss to insurers. Not only does a company lose revenue from a policy when that policy lapses, but a customer is frequently lost as well.

Business intelligence may be used to conduct a lapsation analysis. This is useful in multiple ways. The analysis can be broken down by products, premium payment channels, geographic areas, and other factors.

Depending on the findings, the analysis might be used to:

- Upsell or cross-sell customers insurance products that are more suited to their situation

- Clarify or meet perceive promises that the customer expects

- Streamline and simplify communications for customers

- Address other underlying causes of lapsation

Moreover, this analysis also assists with customer retention and attrition, on both a meta-scale and a micro-scale. Large-scale changes across a segment (and reaching out to customers on an individual basis) are often effective ways to better retain customers and reduce policy lapses.

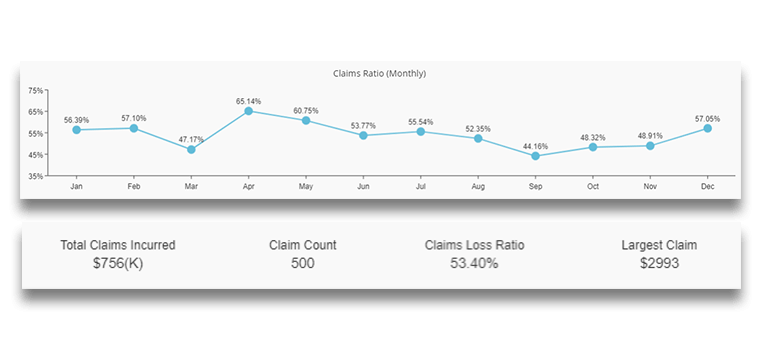

Claims Management - Better Understanding of Policy Claims

As essential as the premium analysis is to top-line revenue, claims management analyses are essential to understand an insurance company's most significant expenses. Concerning claims management, there are two main ways that business intelligence is beneficial.

Claims Analysis

Claims analysis keeps insurance companies current on policy claim trends, and business intelligence makes it possible to see these trends according to an insurance product, distribution channel, geographic area, and other factors.

This type of analysis not only helps review products for overall performance, but analysis is also instrumental when identifying patterns of fraud. For example, claim abuse that's facilitated by healthcare providers may be identified through an analysis of the geographic area and other factors. Policy fraud can also be detected through a similar investigation.

Claim Payment Analysis

Claim payment analysis is a fairly straightforward process, but it's crucial, nonetheless. Business intelligence insights help optimize the claim payment process so that there aren't any unnecessary delays that could negatively impact customer satisfaction.

Marketing and Sales Management - More Efficient Lead Generation and Conversion

On the marketing and sales side of an insurance company's operations, business intelligence provides data and projections that assist with more efficiently generating and converting leads.

Demographic Analysis

Marketing efforts may begin with a demographic analysis, in which companies identify the different types of customers who may be interested in a particular product or range of products.

This information is used to select target audiences for marketing campaigns, upsell and cross-sell customers, and tailor sales strategies to reach the appropriate potential customers.

Product Analysis

Whereas demographic analysis approaches marketing from a customer-centric point of view, product analysis develops potential customer profiles from a product-centric perspective. When these two analyses are paired together, the overlapping matches are promising potential customers.

Campaign Analysis

Once a campaign is launched to reach a target customer segment, business intelligence is focused on the effectiveness of that campaign. The insights gathered help fine-tune the campaign for a better return on investment, and the insights frequently lead to even more effective campaigns in the future.

Channel Analysis

When deciding how to reach customers, channel analysis reveals the return on investment that various channels provide for maximum optimization.

By drilling down according to geographic region, customer segment, product line (and other factors), companies can identify the most effective ways to reach their target customer bases in cost-effective manners.

Broker and Agency Analysis

An aspect of channel analysis, business intelligence software also provides the data necessary to analyze brokers and agencies individually. Comparing brokers and agencies to their peers based on geographic region, overall size, or product lineup benefits both the insurer and the broker.

For an insurer, broker and agency analysis can accelerate sales via the most effective brokers and agencies. The analysis may also suggest decreasing investments in low-performing brokers.

For brokers and agencies, these insights identify the best practices to share. With data-backed analysis, it should be easy to get brokers and agencies to adopt best practices that have been proven to work.

Learn more about how BI can improve insurance processes.

From top-end revenue to mitigating claims expenses, there are numerous ways BI software and the effective use of data visualization can improve performance.